Two years ago, during a brainstorming session at Customer Contact Week, a customer service leader from a government agency stated that it wanted its service to be as good as Nordstrom’s. What was a surprise at the time has become a new norm. Customers expect similar levels of customer service across industries.

Now, the financial services industry—always an early adopter of new technology—is going through a wave of Uber- or Amazon-like digital disruption that will not stay within just financial services but will roll over into all industries. The smarter, more agile companies—midsized companies or large enterprises—will ride the wave and grow while others will struggle to stay relevant.

So what does this wave look like and what should customer service leaders in other industries be aware of? Let’s dive into what is happening in financial services and some lessons learned to see….

Fintech, Then and Now

Digital disruption has swept up the financial services industry, as traditional big banks are challenged by digital banks like Tangerine, traditional investment firms are challenged by companies like Wealthfront, and companies like Square or PayPal become digital financial services firms using innovative technology.

Many of the old-school companies are now either buying the financial tech (i.e., fintech) companies who plan to usurp them, partner with them, or just leverage the technology into their customer services operations.

To reduce effort and increase personalization, banks have turned to biometrics to authenticate. Rather than being greeted with an impersonal “name, rank, and social security number please” message, biometrics do the work and the agent can then greet them personally. Similarly, with 90% of consumers preferring online banking regardless of age, companies have rolled out chat, text communication, and other forms of self-service. And more innovative companies are looking at video to increase personalization. Omnichannel banking is here, where the best of digital self-service is seamlessly blended with agents.

The shift to digital self-service can be significant to business. Take a look at Wells Fargo, for example, which announced earlier this month that it’s eliminating up to 10% of its workforce as a result of customers moving to digital channels and self-service. This is similar to AIG’s announcement a couple years ago to slash over a billion dollars of expenses as the company made similar moves to self-service and digital channels. Many of these shifts to digital channels and self-service are lessons other industries should heed and learn from.

So how do you compete if you are a midsize financial services company or large enterprise bank—or even in another industry? Customer service and customer experience remain the top strategy to win, especially when coupling this with disruptive digital approaches.

Let’s look at some key ways to win in financial services, ways that also are relevant to other industries too.

Key #1: Digital Channels of Choice

To stay relevant, it is key that your company handle not just classic channels such as voice, chat, email, and text, but also emerging digital channels like bots, messengers (e.g., Facebook Messenger, LINE, and Telegram) and video.

Chat was the fastest growing channel most recently, but experts predict new messaging channels will overtake chat in the next wave. Forrester is actually predicting the average number of channels people will use often will increase from 9 to 11. Agents need to be able to communicate over these new channels and be able to hop across them if they have the right skills for the new channels.

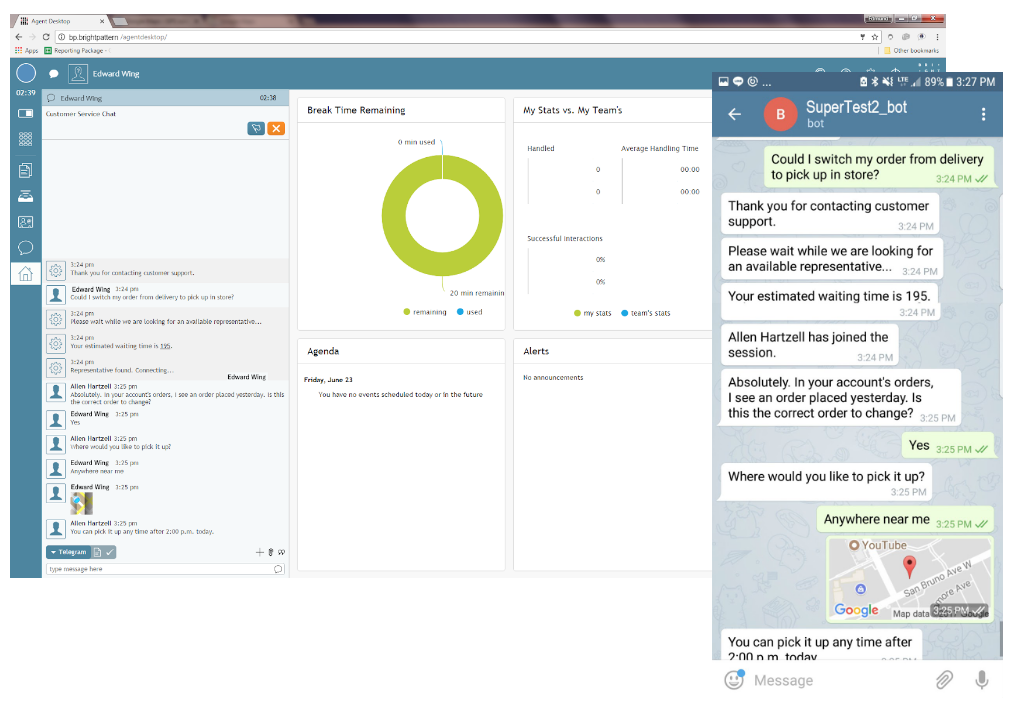

Similarly, channels that customers prefer need to be offered to customers as a way to communicate with their digital banks. Bright Pattern, for example, has traditional channels like voice, email, and text, but also powerful new channels like bots and messengers. So the first takeaway is to provide customers with their digital channel of choice, both classic and emerging.

Key #2: Maintain One Conversation in Context

As communications happen over an increasing number of channels, you need a way to unify all these siloed interactions. If you want to keep customers and deliver frictionless communications, look for the entire customer journey rather than individual communications for each channel.

If you are communicating with a bot and then an agent, the agent should have at his or her fingertips all the context from communication on previous channels so they can provide an effortless customer experience. A single unified desktop that allows agents to see the full conversation in context empowers agents and makes for a much better experience for customers—whether you’re a digital bank or are in any other industry.

Key #3: Digital Conversations for a Mobile World

In addition to unifying all your channels in context, it is important to communicate with people where they are. In our super-busy, high-tech world, people are often looking at their mobile phone on trains, planes—and all too often—their automobiles. People are on the go. COPC recently reported that mobile care will increase 41% in 2018.

So make sure that your top channels can be accessed on mobile devices wherever the customer may be. Bright Pattern, for instance, allows in-app chat, file sharing, video chat, and more.

Banks had some of the most useful apps when they first created the deposit-by-picture feature. Yet, when you hit the “contact us” button in most apps in other industries, you are routed to a general phone number where an IVR asks you what language you speak rather than offer personal service.

Companies should take a mobile, personalized approach to their communications. Put the conversation where people are—and that is on the go.

Key #4: Cloud Customer Service is a Key Enabler

So how do you do all this—add digital channels, communicate seamlessly across them, respond to new channels, and more? Look to the cloud. A true “born from the cloud” customer service architecture where all channels are native versus bolt-on can give you a nimble platform in which you are the disruptor versus disrupted.

Cloud-first architecture is a truly agile, nimble platform because it doesn't rely on legacy technology ported from old on-premises solutions. A cloud platform approach will break down the silos and deliver a simple solution that business users can make changes to without requiring costly IT and professional services. Our e-book explains how to safely transition your contact center to the cloud.

Final Thoughts?

The wave of disruption is everywhere, rolling through financial services and hitting other industries too. Bright Pattern is working with companies who are digital disruptors in industries like travel, financial services, high-tech, healthcare who have learned and put in play the keys I shared with you.

Ready to join the world of digital disruption sweeping through financial services? There is a brighter way to deliver disruptive customer service that smart companies are using, and it starts in the cloud.

I hope some of these keys were helpful. To learn more about staying relevant in this world of digital disruption, see Bright Pattern’s free e-book, 5 Keys: Effortless and Personal Omnichannel Customer Service.