Financial services firms need to do a better job integrating and understanding their customer experience data.

Financial services firms need to do a better job integrating and understanding their customer experience data.

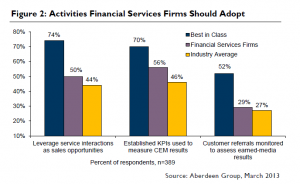

Research from Aberdeen Group shows that financial services firms tend to struggle with the quality of the data in their customer experience management (CEM) programs, and have a tougher time monetizing gains in customer satisfaction.

An Aberdeen study reports that financial services firms are 52 percent more likely (41 percent vs. 27 percent) to struggle with the quality of their data than other firms.

And only 36 percent of financial services firms have standardized their customer data across the enterprise, negatively impacting their ability to create a 360-degree view of all customer interactions.

All of this makes it harder to distinguish more profitable customers from less profitable ones.

Complicating matters is the wide range of channels that financial services firms use to interact with customers: Email, web, print, call center (voice), social media, events, interactive voice response and online video.

Aberdeen recommends that financial services firms make better use of data within their enterprise systems (CRM, contact center) to build fuller customer profiles and enable cross- and up-sell opportunities.

Also, Aberdeen encourages these firms to increase focus on data security to minimize the possibility of non-compliance with internal or external regulations.